Was reading Ronan Lyon’s excellent blog today and it occurred to me that perhaps his comments on income tax are only part of the picture.

Even if we ignore consumption taxes, I’m not sure it matters to the person paying whether it’s income tax they’re paying or other forms of levies such as income or health. Ultimately, they all go into the pot and reduce take-home pay.

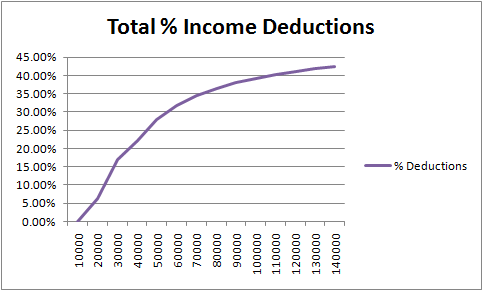

I calculated % total deductions from gross income for salaries from €10k to €140k.

I based my calculations on Hookhead’s 2010 tax calculator which I converted to spreadsheet form. Total deductions are shown in the graph below.

It’s far from linear with many middle income earners paying over Ronan’s target of 15% 🙂 I suppose if you take 25k as the median then they’re already paying about that.

The steepest rises occur between about 20k and 35k but they’re quite steep throughout what I’d class as middle income bands. Someone on 20k a year for example pays 6.38% of deductions. Someone on 50k pays 28.86%. A whopping >22% increase (actually 25.31% delta of your 50k salary) Now if we compare another 30k band 80k (@ 36.48%) to 110k (@ 40.23%) we see that the percentage change in deductions is much less. They’d pay ~15k more tax which is 13.7% of their new 110k salary. i.e. those on middle-ish incomes benefit less from increases in their gross salaries whereas those earning multiples of the industrial wage have greater incentive to earn more.

Just to clarify, I’m not suggesting there’s no benefit, just that our supposedly progressive tax curve may discourage middle earners from being more industrious and also encourage tax-evading “cash nixers”. This behavioral economics effect is something we’ve all heard of even if most choose to play by the rules, of course 🙂

Another legacy of our tax curve is the amount of time+effort put into avoiding taxation by middle income earners during the boom. Anecdotally, our mediation practice has found that people developed a fondness for property investment tax reliefs such as section 23 with assistance from enthusiastic tax accountants. These are not the “rich” but high middle income earners and those in the foothills of camp “well off”. People felt that not availing of these tax breaks was “leaving money on the table”.

While not uncommon, our tax curve is effectively regressive even if it isn’t technically so as there’s an ever decreasing increase in the total deductions as you earn more. When I have the time I’ll calculate the changes in these deductions over time. I believe that the austerity budgets have and will make it even less worthwhile for the average joe to work harder and increase their income unless they can jump the income gap into the “well off” camp.

So I don’t believe it’s the case that people aren’t paying enough taxes (even though the gov will try to extract blood from stones). We’re actually paying too much. Our tax system is labyrinthine and appears to actually discourage personal industriousness. However a flat tax rate of 15% would incentivise the middle incomes to earn more, may result in increased productivity, create a more just tax system and could coincide with more cost-efficient and streamlined processing of the current jumble of taxes, social insurance and levies. A modification would be a flat wealth tax of 30% on all income over 100k including CGT.

But what about PS salaries? How do we pay them? Well it’s quite simple – in theory. We can simply cut everybody’s salaries so they’re getting a little bit more take-home pay then they’re getting now but on the lower tax rate. That’s everybody including judges and medical consultants. This would slash my own Gross salary. So what? I’d be better off in the long term. We then have a big round of paid redundancies in the dept. of social welfare and revenue commissioners as the new tax system is so straightforward. So much administration in just dealing with tax. Have a flat VAT rate and we could improve things even more. There are 7000 staff in the revenue commissioners alone, all working away on our wrong-sized tax system. Think of all those smart kids who waste valuable time and energy that could be harnessed for productive purposes learning tax law 😀

Private industry could adjust wages similarly and Ireland becomes more competitive overnight. Tax consultants would be appalled and some rendered largely irrelevant. However, I’ve often thought that would be a sign of a truly evolved civilisation – one that doesn’t need tax accountants.

Obviously I’m being a bit tongue-in-cheek here but reforming the tax system _may_ be one step towards a more industrious and entrepreneurial Ireland, something we desperately need.